Table of Content

What is Stripe? An Overview of Its Payment Solutions

Stripe Business Model: How It Powers Payments and Integrates Seamlessly

Stripe’s Revenue Model: How It Earns and Stands Out in the Payment Industry

Key Features of Stripe’s Payment Processing Software

In the rapidly evolving fintech landscape, Stripe has emerged as a formidable leader, processing over $1 trillion in transactions annually. Founded in 2010, Stripe has revolutionized how companies handle financial transactions by offering a seamless and secure platform that integrates effortlessly with various business models. Its global reach and user-friendly interfaces have made Stripe a preferred choice for both startups and established enterprises, solidifying its position as a key player among payment processing platforms.

Understanding the Stripe business model and revenue model is crucial for businesses aiming to leverage its capabilities. Stripe’s approach combines simplicity with powerful features, enabling companies to process payments efficiently while focusing on growth. By delving into how Stripe structures its services and generates revenue, businesses can gain insights into optimizing their own payment processes and enhancing customer experiences.

As we explore the intricacies of Stripe’s offerings, it becomes evident why it is often regarded as the best payment gateway in the USA. With a comprehensive suite of tools and a robust infrastructure, Stripe continues to set the benchmark for payment processing software. This blog will delve into the components of Stripe’s success, comparing it with companies similar to Stripe and exploring its impact on the fintech industry.

What is Stripe? An Overview of Its Payment Solutions

Stripe is a leading online payment software that empowers businesses to accept payments and manage transactions seamlessly. Designed to be intuitive and developer-friendly, Stripe provides a robust infrastructure that supports a wide range of payment methods, including credit cards, digital wallets, and local payment systems. Its API-driven architecture allows for easy integration with websites and mobile apps, making it an ideal choice for businesses of all sizes looking to streamline their payment processes.

Stripe offers a comprehensive suite of services and solutions tailored to meet the diverse needs of businesses. From facilitating online payments and managing subscriptions to handling fraud prevention and compliance, Stripe covers every aspect of the payment lifecycle. Additionally, Stripe’s powerful analytics and reporting tools enable businesses to gain valuable insights into their financial operations, enhancing decision-making and optimizing revenue streams.

In the landscape of payment processing platforms, Stripe stands out due to its innovation and flexibility. Its ability to adapt to the evolving needs of businesses and consumers alike has positioned it as a trailblazer in the fintech industry. By providing reliable and scalable payment solutions, Stripe not only simplifies the transaction process but also contributes to the growth and success of countless businesses worldwide.

Stripe Business Model: How It Powers Payments and Integrates Seamlessly

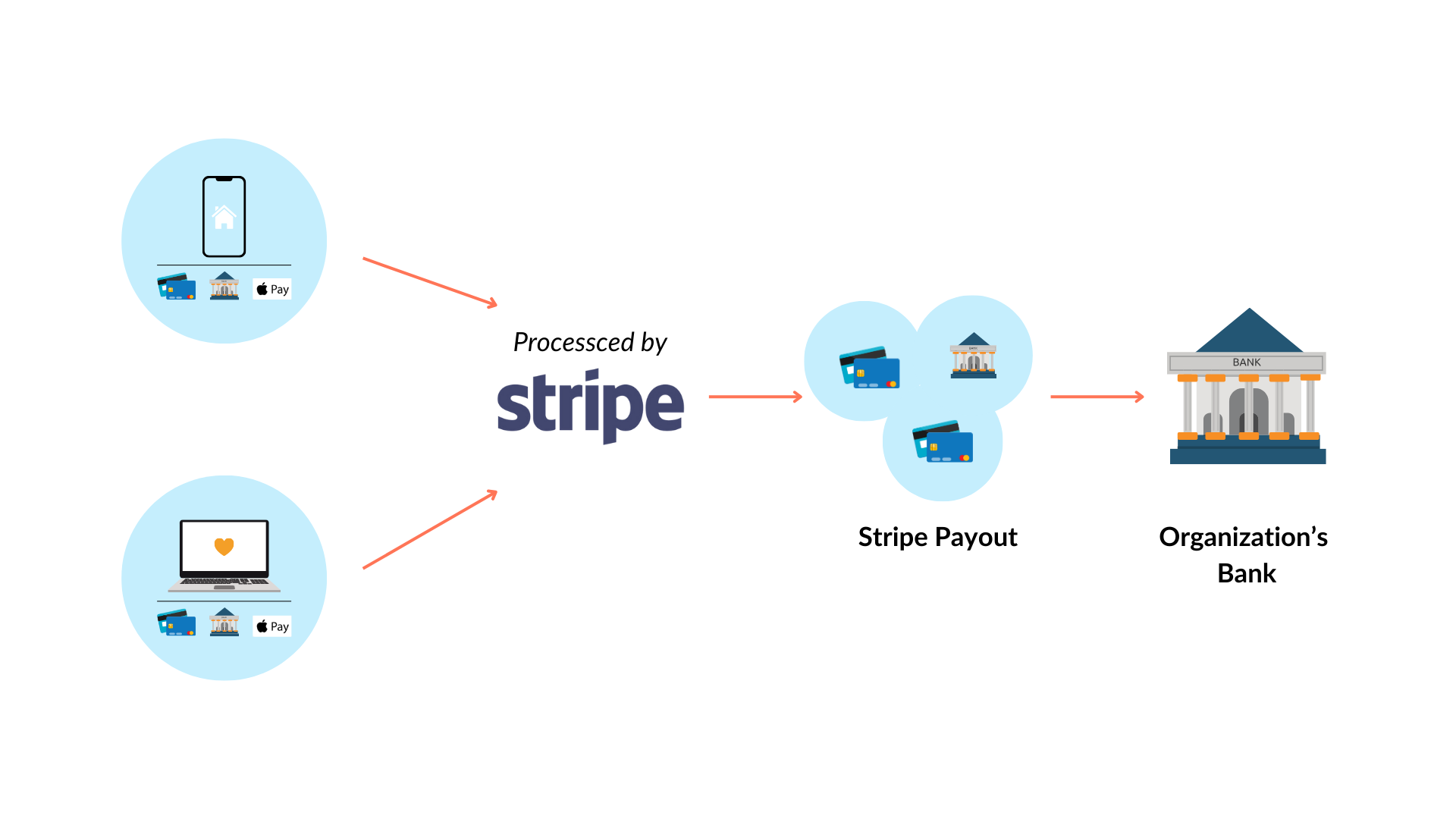

Stripe’s business model is designed around providing a seamless and efficient payment processing experience for businesses worldwide. At its core, Stripe charges a transaction fee for each payment processed through its platform, typically taking a small percentage of the transaction amount plus a fixed fee. This straightforward pricing model appeals to businesses of all sizes, offering transparency and predictability in costs. Additionally, Stripe offers premium services such as advanced fraud protection, subscription billing, and financial reporting, which can be accessed for additional fees, further enhancing its revenue streams.

Facilitating transactions through Stripe is a straightforward process thanks to its powerful API-driven architecture. Businesses can easily integrate Stripe into their websites or mobile applications, enabling them to accept a wide variety of payment methods, including credit and debit cards, digital wallets, and local payment options. This flexibility ensures that businesses can cater to their customers’ preferred payment methods, enhancing customer satisfaction and increasing conversion rates. Moreover, Stripe’s scalable infrastructure supports businesses as they grow, from startups to large enterprises, without compromising on speed or reliability.

In the broader ecosystem of payment processors, Stripe plays a crucial role by setting industry standards for innovation and ease of use. It not only competes with other payment processors like PayPal and Square but also complements them by offering unique features and integrations that enhance the overall payment processing experience. Stripe’s commitment to continuous improvement and expansion into new markets has solidified its position as a leader in the fintech space, driving advancements in payment processing technology and setting benchmarks for others to follow.

Stripe’s Revenue Model: How It Earns and Stands Out in the Payment Industry

Stripe generates revenue primarily through a well-structured fee system that includes transaction fees, subscription charges, and additional service fees. The core of Stripe’s revenue comes from transaction fees, where it takes a small percentage of each payment processed through its platform, along with a fixed fee per transaction. This model provides a steady stream of income based on the volume of transactions, making it scalable and aligned with the growth of its customers. Additionally, Stripe offers subscription-based pricing for its advanced features, such as recurring billing and fraud prevention tools, allowing businesses to choose plans that best suit their needs and budget.

Beyond transaction and subscription fees, Stripe also monetizes through a range of value-added services. These include premium features like advanced reporting, international payments, and customized solutions for large enterprises. Stripe’s marketplace for additional products, such as Stripe Atlas for company formation and Stripe Terminal for in-person payments, further diversifies its revenue streams.

When compared to companies similar to Stripe, such as PayPal and Square, Stripe’s revenue model showcases distinct differences and advantages. While PayPal also relies heavily on transaction fees, it has a broader focus on consumer payments and peer-to-peer transactions. Square, on the other hand, combines transaction fees with additional revenue from point-of-sale hardware and financial services. Stripe’s emphasis on a developer-centric approach and its extensive suite of tools for online and in-person transactions offer a more integrated solution, positioning it uniquely in the payment processing landscape. This strategic focus enables Stripe to capture a significant share of the market by catering to the needs of both small startups and large enterprises.

Key Features of Stripe’s Payment Processing Software

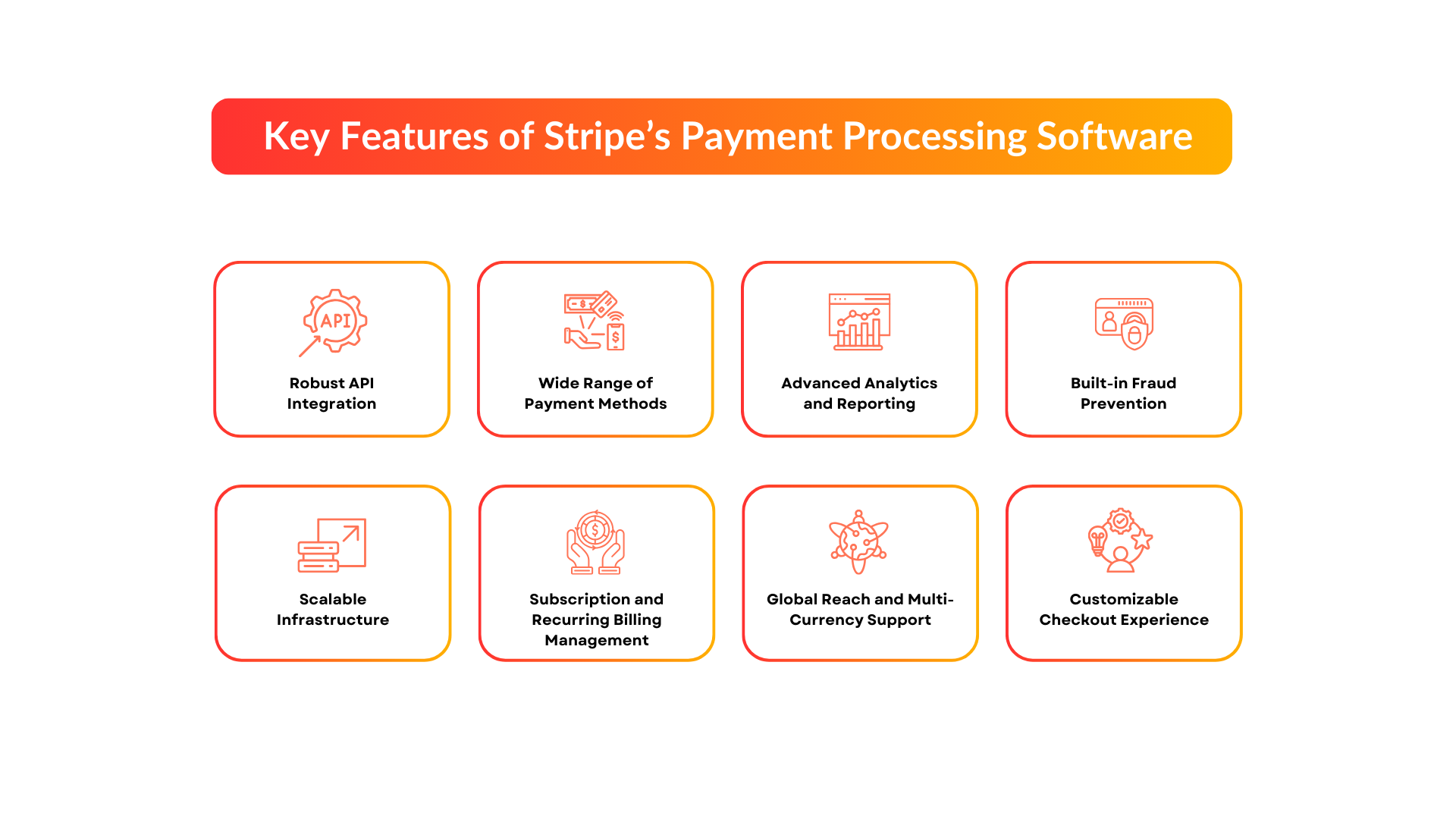

Stripe’s payment processing software is renowned for its cutting-edge technology and innovative features, which collectively enhance the efficiency and reliability of online transactions. The platform is designed to cater to the needs of businesses of all sizes, from startups to large enterprises, providing them with powerful tools to manage and optimize their payment processes. Here’s a closer look at the key features that make Stripe stand out in the competitive payment processing landscape:

Robust API Integration

Stripe’s API allows for easy integration into websites and mobile apps. This flexibility helps businesses create customized payment solutions that fit their specific needs, ensuring a smooth user experience.

Wide Range of Payment Methods

Stripe supports a variety of payment methods, including credit and debit cards, digital wallets, and local payment options. This broad support helps businesses cater to a diverse global audience and enhances customer convenience.

Advanced Analytics and Reporting

The platform offers powerful analytics and reporting tools. These features provide businesses with insights into transaction data and customer behavior, enabling them to make informed decisions and optimize their financial strategies.

Built-in Fraud Prevention

Stripe includes advanced fraud detection and prevention tools. By leveraging machine learning and customizable security settings, it helps protect businesses from fraudulent transactions and minimizes associated risks.

Scalable Infrastructure

Stripe’s infrastructure is designed to scale with growing businesses. It handles increased transaction volumes and evolving needs, ensuring consistent performance and reliability as businesses expand.

Subscription and Recurring Billing Management

The platform provides comprehensive tools for managing subscriptions and recurring billing. This functionality simplifies the management of subscription-based services and ensures efficient revenue collection.

Global Reach and Multi-Currency Support

Stripe supports transactions in multiple currencies and international payments. This global reach allows businesses to operate in various markets and attract customers from around the world.

Customizable Checkout Experience

Stripe allows for customization of the checkout process to align with a business’s branding. This feature enhances the customer experience by providing a consistent and personalized payment interface.

The Best Payment Gateway in the USA?

Stripe is often hailed as one of the best payment gateways in the USA, thanks to its comprehensive suite of features and user-friendly design. It provides businesses with a powerful platform for processing payments online, managing subscriptions, and handling transactions globally. Stripe’s reputation in the USA is built on its robust technology, scalability, and developer-friendly API, which makes it an attractive choice for both startups and established companies.

When comparing Stripe with other top payment processors, several factors come into play:

- PayPal: PayPal is widely recognized for its ease of use and strong brand presence. It offers a range of payment solutions, including personal and business accounts, and is well-suited for consumer transactions. However, while PayPal excels in customer recognition and ease of use, Stripe offers a more integrated solution for online and recurring payments, with greater customization options and advanced features.

- Square: Square is known for its straightforward pricing and integrated point-of-sale (POS) systems, making it a popular choice for retail and small businesses. Its strength lies in in-person payments and its user-friendly hardware. Stripe, on the other hand, provides a more extensive array of online payment solutions, making it better suited for e-commerce businesses and those with complex payment needs.

- Authorize.Net: As one of the older players in the payment processing industry, Authorize.Net offers reliable payment gateway services with a focus on security and customer support. While it provides solid features, Stripe’s modern technology stack and developer tools offer a more flexible and scalable solution for today’s digital economy.

Stripe’s position as a leading payment gateway in the USA is reinforced by its innovative technology, extensive feature set, and ability to adapt to various business models. Its comprehensive approach to payment processing, coupled with its focus on scalability and customization, makes it a standout choice for businesses looking for a sophisticated and reliable payment solution.

How to Build a Fintech App Like Stripe?

Creating a fintech app like Stripe involves leveraging advanced payment processing technology to build a sophisticated and reliable financial platform. Stripe’s robust API provides a comprehensive toolkit for integrating payment functionalities into your app, enabling features such as seamless transaction processing, subscription management, and multi-currency support. By utilizing Stripe’s extensive documentation and developer resources, you can efficiently embed these payment capabilities into your app, ensuring a smooth and user-friendly experience for your customers.

In addition to payment processing, Stripe offers advanced tools for fraud prevention and analytics. Its machine learning algorithms help detect and mitigate fraudulent transactions, safeguarding your app’s security and reducing the risk of financial loss. Furthermore, Stripe’s analytics and reporting features provide valuable insights into transaction data and user behavior, allowing you to optimize your app’s performance and make informed business decisions.

Partnering with a fintech app development company, such as InfoStride, is crucial for building a fintech app like Stripe. InfoStride specializes in custom software development services, ensuring that your app meets industry standards for security, compliance, and scalability. Our fintech app development services include MVP development services, which allow you to launch a minimum viable product quickly while validating key features and market fit. We also offer expertise in designing user interfaces, integrating payment gateways, and performing rigorous testing to deliver a high-quality app.

By collaborating with InfoStride, you can leverage Stripe’s platform to create a powerful and innovative financial application. Our team’s expertise will help you navigate regulatory requirements, implement best practices for security and performance, and develop a feature-rich app that stands out in the competitive fintech landscape.

Also Read: Fintech App Development Cost

Conclusion

Stripe has made a significant impact on the fintech industry by revolutionizing the way businesses handle online payments. With its powerful API, wide range of payment methods, and advanced features like fraud prevention and analytics, Stripe has become a go-to solution for companies seeking to streamline their payment processes and enhance their financial operations. Its innovative approach has set new standards in the payment processing landscape, making it easier for businesses of all sizes to manage transactions, subscriptions, and global payments efficiently.

Looking ahead, the future of payment processing software and platforms is poised for continued evolution. As technology advances, we can expect to see even greater integration of artificial intelligence and machine learning to further enhance fraud detection, optimize transaction processes, and personalize customer experiences. Payment platforms will likely continue to expand their capabilities to support emerging payment methods, such as digital currencies and biometric authentication, reflecting the growing demand for secure and seamless financial transactions.

Stripe’s ongoing innovation and commitment to improving payment solutions position it well to remain a leader in the fintech space. As businesses increasingly rely on digital payment solutions, platforms like Stripe will play a crucial role in shaping the future of financial technology, driving advancements, and setting new benchmarks for the industry.

Frequently Asked Questions

1. What is Stripe’s business model?

Stripe’s business model revolves around providing a comprehensive payment processing platform for businesses of all sizes. It earns revenue primarily through transaction fees, which are charged for each payment processed. Additionally, Stripe offers a suite of products and services, such as billing and fraud prevention, which contribute to its revenue. Its business model is designed to scale with its clients, offering flexible solutions that grow with their needs.

2. How does Stripe generate revenue?

Stripe’s revenue model is based on several streams, including transaction fees, subscription fees, and additional service charges. It charges a percentage fee per transaction plus a fixed fee, which varies by country and payment method. Stripe also offers premium services such as advanced fraud protection and customizable billing solutions, which generate additional revenue.

3. What are some notable apps like Stripe?

Apps like PayPal, Square, and Adyen are notable alternatives to Stripe. PayPal is known for its ease of use and widespread adoption for both personal and business transactions. Square excels with its integrated point-of-sale systems and is popular among small businesses. Adyen offers a global payment solution with extensive features for large enterprises, similar to Stripe’s comprehensive approach.

4. How can I build a fintech app like Stripe?

Building a fintech app like Stripe involves leveraging advanced payment processing technology to create a reliable financial platform. Start by integrating a robust payment gateway API, such as Stripe’s, to handle transactions, subscriptions, and multi-currency support. Ensure your app includes features like fraud prevention and detailed analytics. Collaborating with a fintech app development company can provide the expertise needed to design, develop, and secure your app effectively.

5. What are the key components of a fintech app similar to Stripe?

Key components of a fintech app similar to Stripe include a robust payment processing system, fraud prevention tools, subscription management, and multi-currency support. Additionally, the app should offer advanced analytics and reporting features to help businesses understand transaction data and user behavior. Integration with other financial services and ensuring regulatory compliance are also crucial for a successful fintech app.

6. How does Stripe’s revenue model compare to other payment processors?

Stripe’s revenue model is similar to other payment processors in that it primarily earns from transaction fees and value-added services. However, Stripe differentiates itself with a developer-centric approach, offering a highly customizable API and extensive documentation. This allows businesses to integrate Stripe’s solutions more seamlessly compared to some competitors, who may offer less flexible or more traditional payment processing models.

7. What benefits does a fintech app development company bring to building an app like Stripe?

A fintech app development company provides expertise in creating complex financial applications, ensuring your app meets industry standards for security, compliance, and scalability. They offer services such as designing user interfaces, integrating payment gateways, and conducting thorough testing. Their experience helps streamline the development process and ensures that the app is feature-rich, secure, and capable of handling various financial transactions efficiently.

THE AUTHOR

Infostride